Some Of Top 5 Forex Trading Strategies for Success in the Market

Understanding the Basics of Forex: What You Need to have to Recognize

Forex, quick for international exchange, is the worldwide industry for investing unit of currencies. It is the biggest and most liquid economic market in the world, with an average regular trading quantity of around $6 trillion. Currency investing includes purchasing one unit of currency and marketing another all at once, along with the goal of making a income coming from modifications in substitution rates. In this post, we will discuss the basics of forex and what you require to know just before getting started.

Currency Pairs

In currency exchanging, currencies are consistently traded in pairs. The 1st unit of currency in the pair is contacted the foundation unit of currency, while the second currency is recognized as the quote or counter money. The value of a unit of currency pair embodies how a lot of the quote currency is needed to buy one unit of the bottom money.

For instance, if you observe a quote for EUR/USD at 1.1000, it indicates that one euro may be swapped for 1.1000 US dollars. In อันดับที่ 4 Exness คะแนนด้านความปลอดภัย 7.85 , EUR is the bottom unit of currency and USD is the quote money.

Major Currency Pairs

There are actually numerous significant money pairs that are widely traded in the forex market. These include:

- EUR/USD (Euro/US dollar)

- USD/JPY (US dollar/Eastern yen)

- GBP/USD (English pound/US dollar)

- USD/CHF (US buck/Swiss franc)

- AUD/USD (Australian dollar/US dollar)

- USD/CAD (US dollar/Canadian dollar)

These pairs are thought about major because they entail unit of currencies from some of the world's biggest economic climates.

Currency Exchange Rate Changes

One crucial idea in forex exchanging is understanding how substitution rates change. Substitution prices can be determined by several variables such as financial record launch, geopolitical events, main banking company policies, and market view.

When a nation's economic condition is carrying out well or its enthusiasm rates are high matched up to various other countries, its currency has a tendency to build up. On the other palm, if a nation's economic situation is straining or its rate of interest rates are reduced, its currency might diminish.

It's necessary to note that substitution rates are frequently altering due to the continuous purchase and selling of unit of currencies through market attendees. Traders assess these variations and help make decisions located on their desires of future exchange price activities.

Leverage and Margin Exchanging

Foreign exchange exchanging often involves the usage of utilize, which allows investors to control much larger placements in the market with a much smaller amount of financing. Take advantage of is conveyed as a proportion, such as 1:50 or 1:100. This means that for every buck in your investing profile, you may manage 50 or 100 dollars in the currency market.

While take advantage of can intensify earnings, it likewise improves the threat of reductions. It's necessary for investors to know how utilize works and make use of it properly.

In addition to take advantage of, forex trading usually needs traders to sustain a scope profile. Frame is a portion of your profile balance that is specified aside as security for your field. It behaves as a padding against possible losses. If your profession relocate against you and your account equilibrium falls below the required frame level, you might receive a frame call from your broker asking you to transfer additional funds or finalize some placements.

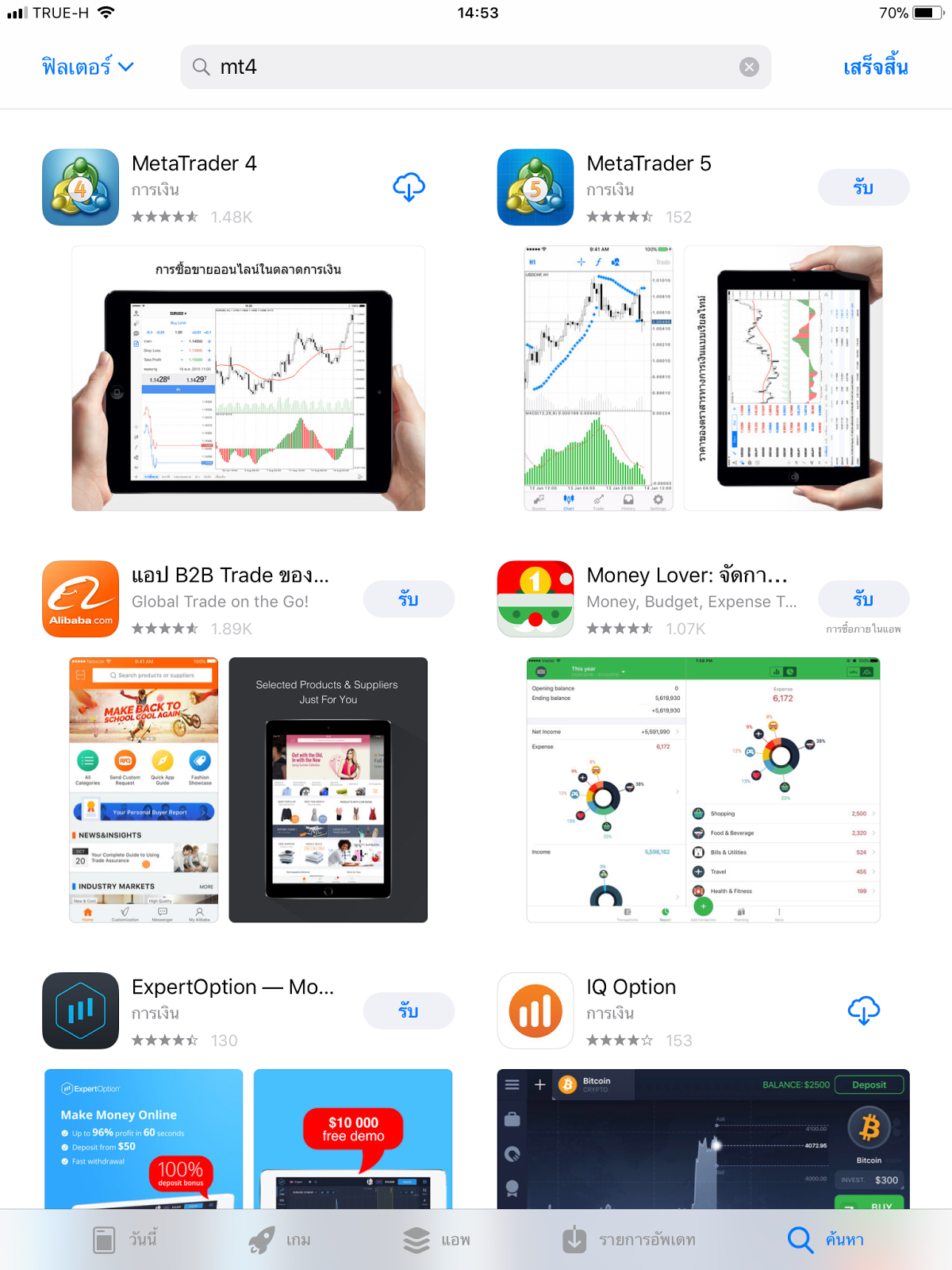

Trading Platforms and Tools

To engage in currency investing, you will definitely need to have gain access to to an internet investing platform delivered by a broker. These systems make it possible for you to perform profession, study charts and clues, track market updates and occasions, take care of your positions, and even more.

There are likewise various devices offered for forex traders such as economic schedules (which deliver relevant information about upcoming economic releases), specialized evaluation indicators (which help pinpoint possible access and exit aspects), and automated investing devices (which permit for mathematical exchanging).

Risk Management

Like any type of form of financial investment or investing activity, foreign exchange exchanging lugs threats. It's vital for investors to have a sound danger management plan in place. This includes establishing realistic income targets and stop-loss purchases, transforming your business, and not running the risk of even more financing than you can easily afford to drop.

Educational Resources

Just before diving into currency exchanging, it's recommended to enlighten yourself regarding the market and trading methods. There are actually numerous informative information on call online such as tutorials, webinars, e-books, and trial accounts where you can engage in trading without running the risk of true cash.

Verdict

Foreign exchange exchanging offers chances for individuals to participate in the worldwide money market. Understanding the basics of currency is crucial before getting began. Inform yourself along with unit of currency pairs, substitution fee variations, utilize and margin investing, exchanging platforms and devices, risk administration techniques, and academic information. Through performing therefore, you are going to be much better equipped to get through the currency market successfully and create informed exchanging choices.

Forex, quick for international exchange, is the worldwide industry for investing unit of currencies. It is the biggest and most liquid economic market in the world, with an average regular trading quantity of around $6 trillion. Currency investing includes purchasing one unit of currency and marketing another all at once, along with the goal of making a income coming from modifications in substitution rates. In this post, we will discuss the basics of forex and what you require to know just before getting started.

Currency Pairs

In currency exchanging, currencies are consistently traded in pairs. The 1st unit of currency in the pair is contacted the foundation unit of currency, while the second currency is recognized as the quote or counter money. The value of a unit of currency pair embodies how a lot of the quote currency is needed to buy one unit of the bottom money.

For instance, if you observe a quote for EUR/USD at 1.1000, it indicates that one euro may be swapped for 1.1000 US dollars. In อันดับที่ 4 Exness คะแนนด้านความปลอดภัย 7.85 , EUR is the bottom unit of currency and USD is the quote money.

Major Currency Pairs

There are actually numerous significant money pairs that are widely traded in the forex market. These include:

- EUR/USD (Euro/US dollar)

- USD/JPY (US dollar/Eastern yen)

- GBP/USD (English pound/US dollar)

- USD/CHF (US buck/Swiss franc)

- AUD/USD (Australian dollar/US dollar)

- USD/CAD (US dollar/Canadian dollar)

These pairs are thought about major because they entail unit of currencies from some of the world's biggest economic climates.

Currency Exchange Rate Changes

One crucial idea in forex exchanging is understanding how substitution rates change. Substitution prices can be determined by several variables such as financial record launch, geopolitical events, main banking company policies, and market view.

When a nation's economic condition is carrying out well or its enthusiasm rates are high matched up to various other countries, its currency has a tendency to build up. On the other palm, if a nation's economic situation is straining or its rate of interest rates are reduced, its currency might diminish.

It's necessary to note that substitution rates are frequently altering due to the continuous purchase and selling of unit of currencies through market attendees. Traders assess these variations and help make decisions located on their desires of future exchange price activities.

Leverage and Margin Exchanging

Foreign exchange exchanging often involves the usage of utilize, which allows investors to control much larger placements in the market with a much smaller amount of financing. Take advantage of is conveyed as a proportion, such as 1:50 or 1:100. This means that for every buck in your investing profile, you may manage 50 or 100 dollars in the currency market.

While take advantage of can intensify earnings, it likewise improves the threat of reductions. It's necessary for investors to know how utilize works and make use of it properly.

In addition to take advantage of, forex trading usually needs traders to sustain a scope profile. Frame is a portion of your profile balance that is specified aside as security for your field. It behaves as a padding against possible losses. If your profession relocate against you and your account equilibrium falls below the required frame level, you might receive a frame call from your broker asking you to transfer additional funds or finalize some placements.

Trading Platforms and Tools

To engage in currency investing, you will definitely need to have gain access to to an internet investing platform delivered by a broker. These systems make it possible for you to perform profession, study charts and clues, track market updates and occasions, take care of your positions, and even more.

There are likewise various devices offered for forex traders such as economic schedules (which deliver relevant information about upcoming economic releases), specialized evaluation indicators (which help pinpoint possible access and exit aspects), and automated investing devices (which permit for mathematical exchanging).

Risk Management

Like any type of form of financial investment or investing activity, foreign exchange exchanging lugs threats. It's vital for investors to have a sound danger management plan in place. This includes establishing realistic income targets and stop-loss purchases, transforming your business, and not running the risk of even more financing than you can easily afford to drop.

Educational Resources

Just before diving into currency exchanging, it's recommended to enlighten yourself regarding the market and trading methods. There are actually numerous informative information on call online such as tutorials, webinars, e-books, and trial accounts where you can engage in trading without running the risk of true cash.

Verdict

Foreign exchange exchanging offers chances for individuals to participate in the worldwide money market. Understanding the basics of currency is crucial before getting began. Inform yourself along with unit of currency pairs, substitution fee variations, utilize and margin investing, exchanging platforms and devices, risk administration techniques, and academic information. Through performing therefore, you are going to be much better equipped to get through the currency market successfully and create informed exchanging choices.

Created at 2023-09-30 23:26

Back to posts

This post has no comments - be the first one!

UNDER MAINTENANCE